Key points

- Unlike police and fire services, emergency medical services (EMS) are rarely classified and funded as "essential services."

- EMS are primarily funded at the local level and often severely underfunded.

- Administration, management, and oversight of EMS systems vary greatly but typically involve collaboration among multiple sectors.

- Local government autonomy may play a crucial role in giving local governments the flexibility to create and fund EMS with limited local resources.

Overview

Local EMS systems vary greatly. This primer begins with a broad overview of EMS in the United States. Subsequently, to better understand at least one model of EMS systems, five local EMS agencies (LEMSAs) in California were studied. The primer may help public health policymakers and practitioners better understand EMS governance, organization, service delivery, funding, and resource allocation. It may also inform resource allocation based on the needs of specific populations.

EMS management, organization, and delivery

EMS systems are managed and governed differently in different states and localities.1 They may be run by a public health department, a county health service agency, or another government entity, but management and governance typically include collaboration across public health, healthcare, and public safety.1 Some states have governing bodies that provide oversight, such as an EMS advisory committee or a commission that consists of members from EMS, fire, healthcare, and public health communities.1 Most states also require oversight from a designated medical director.2

There is typically concurrent state and local jurisdiction over EMS. EMS programs are usually run at the local level but required to comply with regulations set by the state. In some states, local governmental authorities or EMS agencies must provide detailed EMS plans that meet criteria set by the state and are approved by a state-level authority.345 In other states, state requirements are less stringent and may be limited to areas such as EMS certifications, ambulance requirements, and trainings.6

EMS delivery can vary considerably. Local governments determine the transport types that are available to the public, including ambulance or air transportation services, and the provider and dispatch agencies used. EMS may be provided through a public entity, such as a fire department, or by a private organization. Availability of paid EMS staff also varies. For example, rural EMS systems are more likely to rely exclusively on volunteers than their urban counterparts.78 Some states have stroke systems of care policies in place, which may require prehospital assessment, transport, and triage protocols or prehospital notification protocols for suspected stroke cases. All of these factors can affect access to and the quality of services.7

Local authority, state regulation, and funding

In the United States, EMS are primarily provided and funded by local governments, which leads to wide variation in the cost to patients and the quality of services. In many states, EMS are not classified as essential services.8 State governments frequently have EMS regulations, but limitations on available funding can make local compliance challenging.1 Wide reliance on property taxes to fund government services also contributes to disparities.1

Local autonomy may play a crucial role in giving local governments the flexibility to create and fund EMS. However, states can limit local autonomy or impose limits on local taxation that impede this flexibility, as shown in more detail in the five-state fact sheet. A nationwide study found that increases in local tax limitations are correlated with an increase in user fees and charges for services, which can be problematic for low-resourced individuals.9

Although EMS systems are primarily funded at the local level, some other funding sources are available. Most states provide limited funding through general or dedicated funds.10 EMS systems also raise revenue through fees, grants/donations, and contracts.10 Some grant funding may be available through federal agencies including the Department of Health and Human (HHS), the Centers for Disease Control and Prevention (CDC), the Health Resources and Services Administration (HRSA), the Office of the Assistant Secretary for Preparedness and Response (OASPR), the Federal Emergency Management Agency (FEMA), and the National Highway Traffic Safety Administration (NHTSA).10

EMS management, organization, and delivery in California

The California EMS Authority is one of 13 departments within the California Health and Human Services Agency. The EMS Authority is tasked with:

- Developing, implementing, and assessing EMS systems.

- Setting guidelines and standards for training and scope of practice.

- Promoting disaster medical preparedness.11

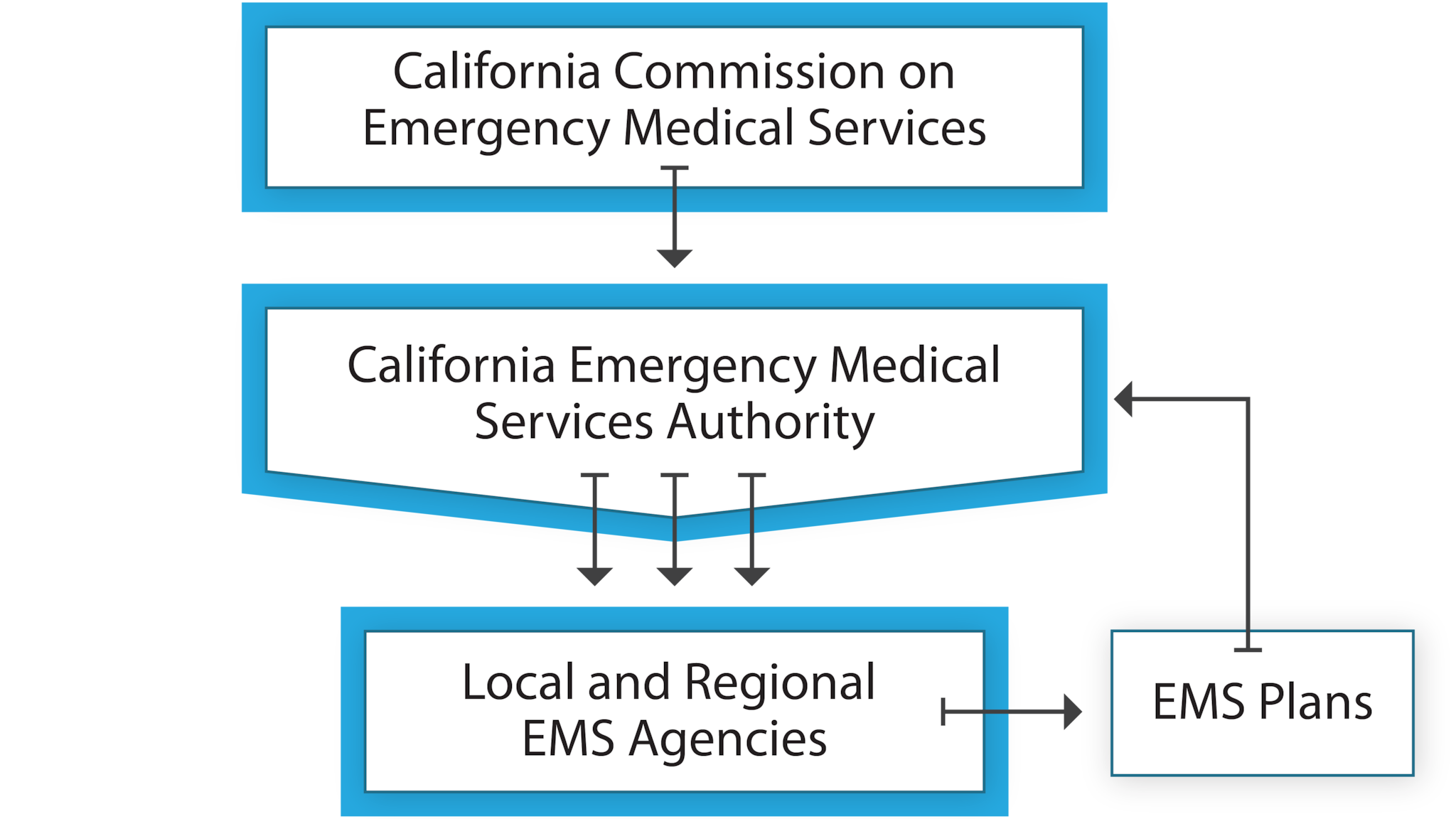

Oversight of the California EMS authority is provided by California's Commission on Emergency Medical Services, which consists of 18 members appointed by the governor, the California State Senate Rules Committee, and the Speaker of the Assembly (Figure 1). Members of the commission approve regulations, standards, and guidelines developed by the authority.12

County governments develop their own EMS programs and designate a local EMS agency (LEMSA), which is typically a county health department or another entity that the county government contracts to oversee the program.

- In California, 33 LEMSAs serve 58 counties.

- LEMSAs are led by EMS directors or administrators and a medical director.

- LEMSAs are responsible for day-to-day EMS system management and operations in California.13

Local authority and state regulation in California

Historically, California is among the states with the greatest levels of local autonomy. However, in 1978, California voters pushed back against what was seen as excessive taxing and spending by local governments through the passage of Proposition 13, which limited local property tax to 1%. Now, California has strict constitutionally imposed tax limits that local governments cannot overturn.14

County governing structures differ in California and include both charter and general counties. Charter counties have substantial autonomy in setting up their government structure and administration, which are laid out in a governing document known as a charter15; however, they are still subject to statewide tax limits.14 General law counties do not have this governing document, and their governmental structure is set out by state law. This case study includes two charter counties (Alameda and Los Angeles) and nine general law counties. These 11 counties form 5 LEMSAs: 3 single-county LEMSAs and 2 multicounty LEMSAs.A

Table 1 shows local special taxes that could fund EMS, fire, or related public improvements. Funding of fire departments is included because fire departments frequently provide EMS. The team reviewed laws from all 11 counties. Laws authorizing special taxes or assessments that could be used to fund EMS were identified in the two charter counties but not in any of the nine general law counties. Special taxes and assessments require approval by two-thirds of the voters and may be easier to pass in charter counties,16 where governments have additional discretion related to the logistics of the election.

Table 1. Authorized Special Taxes and Assessments in 11 Counties in California in 2022

County

Tax Purpose

Tax Amount

This table is based upon laws publicly available in Municode and local government websites. It is up to date as of April 2022. There may be additional laws not included in that source. The 11 counties are Alameda, Alpine, Amador, Calaveras, Del Norte, Humboldt, Kern, Lake, Los Angeles, Mariposa, and Stanislaus. Relevant laws were found in just 2 of the 11 counties.

General property taxes go into the general fund and can be used to provide a variety of services, including EMS. Other general taxes (e.g., sales tax, transient occupancy tax) can be instituted with a simple majority vote.14 Table 2 shows other taxes that contribute to local governments' general fund.

Table 2. Authorized General Taxes in 11 Counties in California in 2022

Sales & Use Tax (1.25%)

Real Property Transfer Tax ($0.55/$500)

Transient Occupancy (Hotel) Tax

This table is based upon laws publicly available in Municode and local government websites. It is up to date as of April 2022. In most counties listed, the original sales tax in 1956 was 1%, but it increased to 1.25% in 1972. There may be additional laws not included in that source. The 11 counties are Alameda, Amador, Alpine, Calaveras, Del Norte, Humboldt, Kern, Lake, Los Angeles, Mariposa, and Stanislaus.

Funding sources and resource allocation in California

In California, examining EMS-related funding sources and resource allocation is possible because LEMSAs produce annual reports with detailed information about their funding sources and revenue. The allocation of resources across five studied LEMSAs varies significantly. Sources of funding for LEMSAs are divided into five categories based on level of governance.

Table 3. Sources of California LEMSA Funding

Conclusions and implications

There is significant variation in how EMS are structured, funded, and managed across the United States, which leads to disparities and potential inequities in the funding mechanisms and comprehensiveness of services provided. Few studies explore how these differences affect EMS. California provides examples of some of the mechanisms that states use to provide EMS by voluntarily making extensive EMS data available through its annual LEMSA reports.

Rural LEMSAs that were included in this case study have fewer resources and generally depend more heavily on state funding sources or the Maddy EMS Fund. The larger LEMSAs in our case study have greater local government autonomy through their charters, which provide substantial flexibility in the administration of their government. This greater flexibility may help pass special taxes and assessments, which can provide additional funding. This case study may help inform state and local policymakers about available EMS funding sources in urban and rural areas.

Glossary

- Charter and general law counties: In California, all counties are either charter counties or general law counties. Charter counties are counties that have created a written document known as a charter that sets forth laws related to their own government, whereas general law counties have no such charter and are therefore governed by applicable state laws.50 Alameda and Los Angeles counties are charter counties; the other counties that we are studying are general law counties. In some limited areas of law, charter counties may include provisions in their charters that supersede conflicting state laws. These areas include how their governing bodies are selected and removed, as well as their salaries and other terms of their tenure. Charter counties may also determine how to perform certain functions required by statute.51 They do not have additional rights related to revenue generation50; however, they have somewhat more flexibility to set dates for their elections relating to issuance of taxes or bonds.52

- EMS district: A special district designated for the purpose of providing emergency medical services to residents.

- EMS levy: A property tax imposed specifically for the funding of EMS.53 Note that in California, EMS levies are often referred to as special taxes for EMS.54

- Fire protection district: A special district designated for the purposes of providing fire protection services to residents. Note that EMS is often provided by fire departments.

- Local autonomy: The extent to which states constitutionally or legislatively grant local jurisdictions the power to enact their own laws to address issues of local concern. This encompasses concepts such as fiscal discretion, decentralization, and home rule.55

- Local EMS agency (LEMSA): This is one of 33 local EMS systems that provide EMS for the 58 counties in California. Seven LEMSAs cover multiple counties; all other LEMSAs serve a single county.56

- Maddy EMS Fund: A fund established to provide critical resources for the delivery of emergency medical care to the uninsured. Funds are managed at the county level, with funding generated through the assessment of an additional penalty of $2 for every $10 collected in fines, penalties, and forfeitures for criminal offenses. Revenue is distributed for county administration costs, as reimbursement to physician/surgeons and hospitals for the cost of uncompensated care, and for discretionary EMS purposes. As of 2019, 51 of the 58 counties in California had established a Maddy EMS Fund.57

- Special district:

- "An agency of the state, formed pursuant to general law or a special act, for the performance of governmental or proprietary functions within limited geographic boundaries, including but not limited to school districts and redevelopment agencies."58

- "A unit of local government, authorized by law to perform a single function or a limited number of functions."59 Examples include fire protection districts, hospital districts, community improvement districts, and EMS districts.

- "An agency of the state, formed pursuant to general law or a special act, for the performance of governmental or proprietary functions within limited geographic boundaries, including but not limited to school districts and redevelopment agencies."58

- Stroke systems of care: Networks that coordinate and promote timely patient access to the full range of activities and services associated with stroke prevention, treatment, and rehabilitation. They also improve patient care and support.60

- At the time we conducted this research, the five LEMSAs that we are studying—Alameda, Kern, Los Angeles, Mountain Valley, and North Coast—contained 11 counties: The North Coast LEMSA had three counties, the Mountain Valley LEMSA had five counties, and the remaining LEMSAs were single-county agencies. Recently, Stanislaus, one of the counties that had been in the Mountain Valley LEMSA, left that LEMSA and formed its own single-county agency. Thus the Mountain Valley LEMSA now has just four counties. However, because all the years studied included Stanislaus in the Mountain Valley LEMSA, we list Stanislaus as part of Mountain-Valley for this study.

- MacKenzie EJ, Carlini AR. Characterizing Local EMS Systems. Report No. DOT HS 811 824. Washington, DC: National Highway Traffic Safety Administration; 2013.

- Slifkin RT, Freeman VA, Patterson PD. Designated medical directors for emergency medical services: recruitment and roles. J Rural Health. 2009;25(4):392–8.

- California Health & Safety Code, § 1797.105 (West 1984).

- 210 Illinois Compiled Statutes Annals, 50/3.25 (West 2014).

- Massachusetts General Laws Annals, ch. 105, § 170.050 (West 2022).

- Texas Health & Safety Code, § 773.050 (West 2023).

- Pozner CN, Zane R, Nelson SJ, Levine M. International EMS systems: the United States: past, present, and future. Resuscitation. 2004;60(3):239–44.

- Freeman VA, Slifkin RT, Patterson PD. Recruitment and retention in rural and urban EMS: results from a national survey of local EMS directors. J Public Health Manag Pract. 2009;15(3):246–52.

- Zhang Z, Hou, Y. The impact of tax and expenditure limitations on user fees and charges in local government finance: evidence from New England. J Federalism. 2020;50(1):81–108.

- National Association of State EMS Officials. 2020 National Emergency Medical Services Assessment [PDF – 10.5MB]. Falls Church, VA: National Association of State EMS Officials; 2020.

- California Emergency Medical Services Authority. About the EMS Authority. Accessed September 2, 2022.

- California Emergency Medical Services Authority. Commission on EMS Information. Accessed September 2, 2022.

- Emergency Medical Services Administrators' Association of California. The Roles and Responsibilities of Local Emergency Medical Services Agencies Within California: A Position Paper by the Emergency Medical Services Administrators' Association of California [PDF – 661KB]. October 2018. Accessed May 17, 2024.

- California Constitution, art. XIII A, § 1.

- Dimon v. County of Los Angeles, 166 Cal., app. 4th 1276. (2008).

- California Constitution, art. XIII C, §2.

- Alameda County Code, California, ch. 2.20, § 2.20.010.

- Alameda County Code, California, ch. 2.24, § 2.24.010.

- Los Angeles County Code, California, ch. 4.56, § 4.56.070 (1959).

- Los Angeles County Code, California, ch. 4.92, §§ 4.92.020, 4.92.030 (date not available).

- Los Angeles County Code, California, ch. 4.81, §§ 4.81.060, 4.81.070 (1986).

- Alameda County Code, California, ch. 2.08, §§ 2.08.040, 2.08.110 (1956).

- Alpine County Code, California, ch. 3.24, §§ 3.24.020, 3.24.040, 3.24.050 (1956).

- Calaveras County Code, Caifornia, ch. 3.08 §§ 3.08.040, 3.08.100 (1956).

- Del Norte County Code, California, ch. 3.04, §§ 3.04.40, 3.04.100 (1956).

- Humboldt County Code, California, div. 1, ch. 1, §§ 711-2, 711-4, 711-5 (1956).

- Kern County Code, ch. 4.12, §§ 4.12.020, 4.12.030, 4.12.040 (date not available).

- Lake County Code, California, ch. 18, art. 1, §§ 18-4, 18-5.

- Los Angeles County Code, California, ch. 4.68, §§ 4.68.040, 4.68.050 (1956).

- Mariposa County Code, California, § 3.32.040, 3.32.090 (1956).

- Stanislaus County Code, California, ch. 4.16, § 4.16.040 (1957).

- Stanislaus County Code, California, ch. 4.16, § 4.16.040 (1957).

- Alpine County Code, California, ch. 3.20, § 3.20.020 (1993).

- Calaveras County Code, California, ch. 3.04, § 3.04.020 (1967).

- Del Norte County Code, California, ch. 3.12, §§ 3.12.20, 3.12.30 (1968).

- Humboldt County Code, California, title VII, div. 1, ch. 3, § 7.13 (1973).

- Kern County Code, ch. 4.20, § 4.20.020 (date unknown).

- Lake County Code, California, art. III, § 18-25. (1967).

- Mariposa County Code, California, art. III, § 3.28.020 (1967).

- Stanislaus County Code, California, ch. 4.12, § 4.12.020 (1981).

- Alameda County Code, California, ch. 2.132, §§ 2.132.030, 2.132.040, 2.132.050 (2003).

- Alpine County Code, California, ch. 3.16, §§ 3.16.030-3.16.050 (2005).

- Calaveras County Code, California, ch. 3.12, § 3.12.030 (1978).

- Del Norte County Code, California, ch. 3.08, § 3.08.30 (1974).

- Humboldt County Code, California, div. 1, ch. 2, §§ 712-3 (1993).

- Kern County Code, California, ch. 4.16, § 4.16.030 (2002).

- Lake County Code, California, art. 2, § 18-12 (1992).

- Mariposa County Code, California, ch. 3.36, § 3.36.030 (2019).

- Stanislaus County Code, California, ch. 4.04, § 4.04.020 (1986).

- California State Association of Counties. County Structures & Powers. Accessed May 5, 2022.

- California Constitution, article XI, § 4.

- Taylor M. A Look at Voter-Approval Requirements for Local Taxes [PDF – 1.57 MB]. Sacramento, CA: Legislative Analyst's Office; 2014.

- Municipal Resources and Services Center of Washington. Emergency Medical Services (EMS) Levies. Accessed September 1, 2022.

- Alameda County Code, Chapter 2.24.

- Wolman H, McManmon R, Bell M, Brunori D. Comparing Local Government Autonomy Across States. Proceedings. Annual Conference on Taxation and Minutes of the Annual Meeting of the National Tax Association. 2008;101:377–83.

- California Emergency Medical Services Authority. Local EMS Agencies. Accessed September 1, 2022.

- Duncan D. Maddy Emergency Medical Services Fund: Statewide Report Summary, Fiscal Year 2018–2019 [PDF – 844 KB]. Sacramento, CA: California Emergency Medical Services Authority; 2021.

- California Constitution, article XIII C, § 1(c).

- Law Insider. Special District Definition. Accessed September 1, 2022.

- Centers for Disease Control and Prevention. Stroke Systems of Care: PEARs. Accessed January 3, 2023.

- Centers for Disease Control and Prevention. Stroke Systems of Care. Accessed October 19, 2022.

- Carson L, Sheppard K. The 2016 Motor Vehicle Occupant Safety Survey: Emergency Medical Services. National Highway Traffic Safety Administration. January 2020. Traffic Tech: Technology Transfer Series. DOT HS 812 870.