Key points

- There are policy approaches, mechanisms, and resources that can help prevent ACEs.

- States vary in their offering of different credits and grants.

About ACEs

Adverse Childhood Experiences, or ACEs, are preventable, potentially traumatic events that occur in childhood such as neglect, experiencing or witnessing violence, and having a family member attempt or die by suicide. ACEs also include aspects of a child's environment that can undermine their sense of safety, stability, and bonding, such as growing up in a household with substance use, mental health problems, or instability due to parental separation or incarceration of a member of the household.1

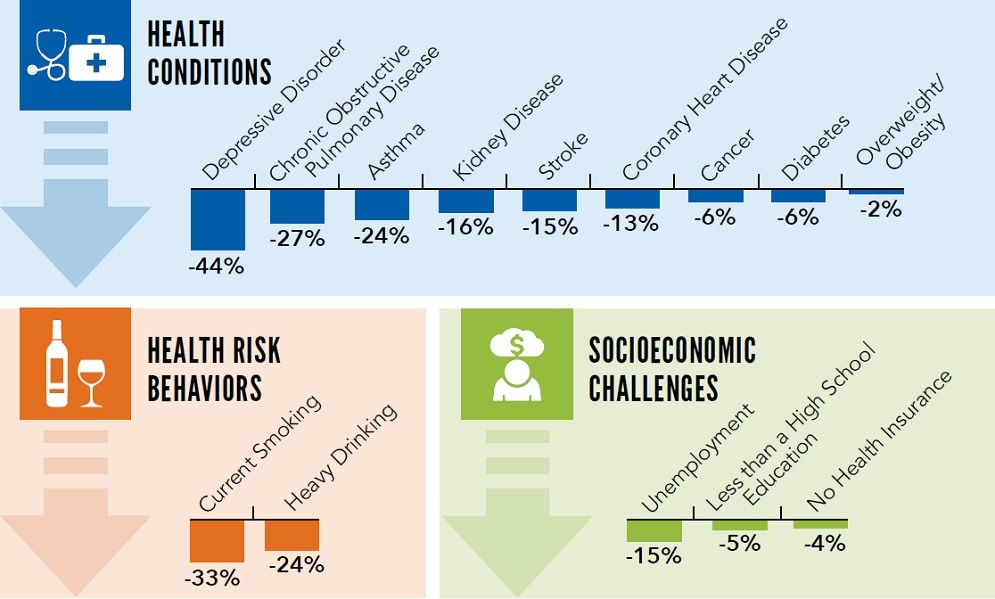

Conditions such as living in under-resourced or racially segregated neighborhoods, frequently moving, experiencing food insecurity, and stress from historical and ongoing trauma due to systemic racism or the impacts of multigenerational poverty can all exacerbate the effects of ACEs. The science behind ACEs is clear: exposure to trauma in childhood has profound effects on health, wellbeing, and opportunity throughout a person's life, including raising the risk for suicide, substance use, and a range of chronic diseases.

Fast facts about ACEs

CDC research shows that about 64% of adult Americans reported they had experienced at least one ACE.

Women, American Indian or Alaska natives, and multiracial people were more likely to experience ACEs in childhood.

ACEs-related health consequences cost an estimated economic burden of $748 billion annually in Bermuda, Canada, and the U.S.

Policy Approaches

CDC's Adverse Childhood Experiences Prevention Resources for Action notes that improving access to high-quality childcare is one approach states and communities can implement to prevent ACEs.

Policy mechanisms that support families with their dependent care needs helps prevent ACEs:

- State Dependent Care Tax Credits

- These can build upon the federal Child and Dependent Care Tax Credit to help low-income families increase their income while offsetting the costs of child-rearing.

- These can build upon the federal Child and Dependent Care Tax Credit to help low-income families increase their income while offsetting the costs of child-rearing.

- Child Care and Development Block Grant

- This grant provides funds for assisting low-income families with childcare while they are working/seeking work or participating in training/education.

- This grant provides funds for assisting low-income families with childcare while they are working/seeking work or participating in training/education.

State policies

For State Dependent Care Tax Credits, state policies vary in several ways:

- Whether they offer the credits

- Whether they designate the credits as "refundable" (that is, if the amount of the credit is higher than the amount a person owes in tax, they will receive money back)

- How they determine who is eligible and for how much support

For Child Care Development Block Grants, there are federal eligibility requirements. States are permitted to establish additional eligibility criteria, including:

- Different income limits

- Specifications for qualifying work or education

What studies show

Additionally, CDC has noted that:

- Parents receiving childcare subsidies tend to choose better quality, safer childcare.

- Compared to states with wait lists, states meeting demand for childcare assistance decreased their child abuse and neglect rates.

- Neighborhoods with more licensed childcare spaces relative to childcare need had lower child abuse and neglect rates.

- Access to affordable, high-quality childcare reduces parental stress and is associated with fewer symptoms of maternal depression. Both parental stress and maternal depression are risk factors for child abuse and neglect.

Policy landscape

State Dependent Care Tax Credits

As of a January 2022 preliminary scan of state laws, 24 states offer State Dependent Care Tax Credits. Of these, 12 states' credits are refundable (in at least some circumstances). Most states' credits are based on a percentage of the federal Child and Dependent Care Tax Credit. Some states (Hawaii, New Mexico, Oregon, and South Carolina) establish their credit as a portion of a person's qualifying dependent care expenses. These credits are designed to help make childcare more affordable for parents and help provide consistent safe, stable, nurturing relationships for children.

Hover on the map below to see whether a state has a State Dependent Care Tax Credit and if the tax credit is refundable.

Child Care and Development Block Grant

The below data are sourced from the Child Care and Development Fund Policies Database, current to October 2020, operated by the Administration for Children and Families. Child Care and Development Block Grant federal eligibility holds that states can offer the grant for children up to age 13 in families with no more than 85% of the applicable state median income and assets not exceeding $1 million. To receive the funding, the parents/guardians must be working, in job training, or in school. States can establish more restrictive criteria for eligibility and have done so in several nuanced ways, summarized by ACF in the document, "Key Cross-State Variations in CCDF Policies as of October 1, 2019."

Hover on the map below to see each state's maximum child age for eligibility is and what the maximum monthly countable income to initially qualify for a family of four.

*Most states extend eligibility longer for children with special needs. Some states also extend eligibility for children in protective services or foster care.

** For income eligibility, Colorado, Texas, and Virginia policies are coded for select counties, as these states permit regional or local jurisdictions to establish their own thresholds. Iowa, Massachusetts, North Carolina, and Utah set different thresholds for families with children with special needs.

Disclaimers

- The findings and conclusions in this product are those of the authors and do not necessarily represent the views of the Centers for Disease Control and Prevention.

- This resource is intended to communicate succinctly and clearly about very complex policies. It is current to DATE. For a comprehensive picture of a given state’s legal landscape, refer directly to current state law.

- The development of this product was supported by Cooperative Agreement CDC-OT18-1802: Strengthening Public Health Systems and Services through National Partnerships to Improve and Protect the Nation’s Health.

- Felitti, V. J., Anda, R. F., Nordenberg, D., Williamson, D. F., Spitz, A. M., Edwards, V., Koss, M. P., & Marks, J. S. (1998). Relationship of childhood abuse and household dysfunction to many of the leading causes of death in adults: The Adverse Childhood Experiences (ACE) study. American Journal of Preventive Medicine, 14, 245-258.